This summer I immersed myself into the drama and intrigue of the evolving B2B Buyer. I read several recent sizzling studies and papers from a variety of sources designed to examine the state of B2B buying and how vendors stack up against the digital expectations of their targets. I have included my list of “hot reads” at the end of this post if you want to dig deeper, but here are the Cliffs notes.

This summer I immersed myself into the drama and intrigue of the evolving B2B Buyer. I read several recent sizzling studies and papers from a variety of sources designed to examine the state of B2B buying and how vendors stack up against the digital expectations of their targets. I have included my list of “hot reads” at the end of this post if you want to dig deeper, but here are the Cliffs notes.

Chapter 1: The Buying Center Takes Shape

Within organizations, especially midsize and up, B2B decision-makers are forming into specialized units called “buying centers” (some use the word “committee” or “group”) and they are continuing to grow in adoption. In fact, 59% of organizations report to have them formally in place1. Buying centers are large, complex and continue to grow. In larger enterprises buying centers can consist of up to 18 people on average2. Yikes!

Buying centers are made up of a diverse group of functions, roles, influence and skills across the business, and they are multi-generational. To muddy the waters further, these groups behave differently along the path to purchase depending on the size of their company and in some cases, the industries they serve. Especially in highly regulated ones like Healthcare and Financial Services.

Chapter 2: B2B Buyers are Stressed Out

B2B buyers are under immense pressure to procure the right technologies and services so that their companies can innovate and stay relevant. And, when the only constant is change, they are forced to regularly stop and start the process depending on the executive priority du jour. These factors add up to an increasing aversion towards risk.

86% purchase decisions are often accelerated or put on hold based on changing biz priorities1.

In some organizations, buyers are becoming agents of change and are the gatekeepers to the C-Suite. Information such as timing and ease of implementation are just as important as TCO and ROI when creating the short list, which is a shift for non IT buyers.

Chapter 3: The Consideration Phase is Grueling

B2B companies are taking a page from their B2C counterparts to help guide their decision-making. Specifically, they are relying more heavily on peer validation and other third-party sources through digital channels (Frankly, they don’t trust vendors, but more on that in the next chapter).

They go through a laborious vetting of vendors, partners, products and services and find it difficult to make apples to apples comparisons. Buyers want to leverage a variety of third-party sources such as analysts and peers. Peer reviews are the number one trusted source of information across all studies and buyer roles. However, this kind of information can be hard to access.

Despite that most customers are happy with their products, only 40% recommended the products to their peers and only 25% wrote an online review.3

99% of buyers value product reviews, but only 60% of content marketers make them a priority.4

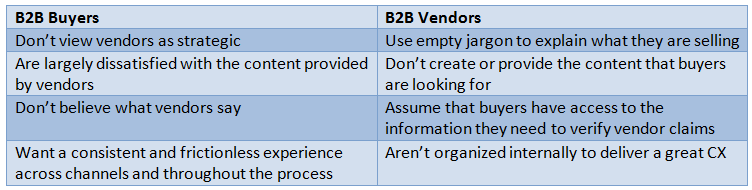

Chapter 4: The Buyer and Vendor Gap Runs Deep

Vendors aren’t helping guide their buyers along the purchase path, but worse yet, can hinder their progress. The consensus is that vendors often create bad content and along with it, poor experiences.

65% of business decision makers say vendor content is useless.5

Buyers’ top pet peeves when it comes to digital content and sales engagement are…

- Too generic or general

- Overuse of “empty buzzwords”

- Unauthentic and sales-y

- Requiring content registration

91% said that easy access to content without registration forms was important and 94% wished their vendors provided informational content that was easy to consume.1

This disconnect has serious implications for the sales and marketing teams that can’t align their efforts and KPIs, because it negatively impacts the customer experience across the entire journey. Here is a look at the dueling perceptions and misconceptions that are unfortunately trending.

Not so fun facts:

- Only 23% of buyers think vendors are strategic.3

- Despite ample choices, 85% of buyers say it’s challenging to find useful info and feel marketers work against their interests and are not in tune with their needs.5

- 62% of buyers said they wanted Sales people to be knowledgeable about the topics they just consumed/downloaded.5

What do B2B buyers need? Clarity, consistency and transparency about the product or service they are considering. Third-party validation from peers and analysts are the most valued types of information, but a big disconnect is that vendors assume these are things widely available to their prospects, when often they are not. Don’t gate everything for the sake of lead generation; buyers want to opt-in to the pipeline of their choice. The more you meet buyers’ needs, the more of a strategic partner you will become.

The implications from the studies are pretty straight forward. B2B vendors: please stop and take a hard look at the content and sales experience from end to end. How do you rate? In today’s digital sales cycle, you don’t want to be “that vendor”…

Hot B2B Reads

- Demand Base, 2017 B2B Buyer Survey Report

- IDG, Enterprise Technology Decisions Become a Business Priority

- Trust Radius, The Vendor Buyer Disconnect

- Spiceworks, Tech Marketers are from Mars, IT Pros are from Venus

- IDG, Content Customization Comes to the Fore

Senior Consultant

Jenny is a digital content strategist, who leads customer-centric engagements that focus on understanding B2B buying behaviors and developing custom roadmaps.

Her expertise is creating buyer personas and mapping digital content journeys to assess the multi-channel user experience. She helps clients operationalize plans across workstreams and identifies processes to create efficiencies in marketing operations. Jenny also has extensive time under her belt developing and managing customer advocacy programs and community building.

She has helped a diverse group of organizations including Cisco, VMware, Verizon, Microsoft, Dell, BMO Harris, Capital One and many others become more customer-centric.